The UK technology market is worth £20bn and the Nordics market NOK152.4bn (£11.0bn). Our scale underpins our long term supplier relationships while our high brand awareness presents a significant opportunity for future growth by expanding our market share.

23.3%Market share in the UK&I | 27.7%Market share in the Nordics |

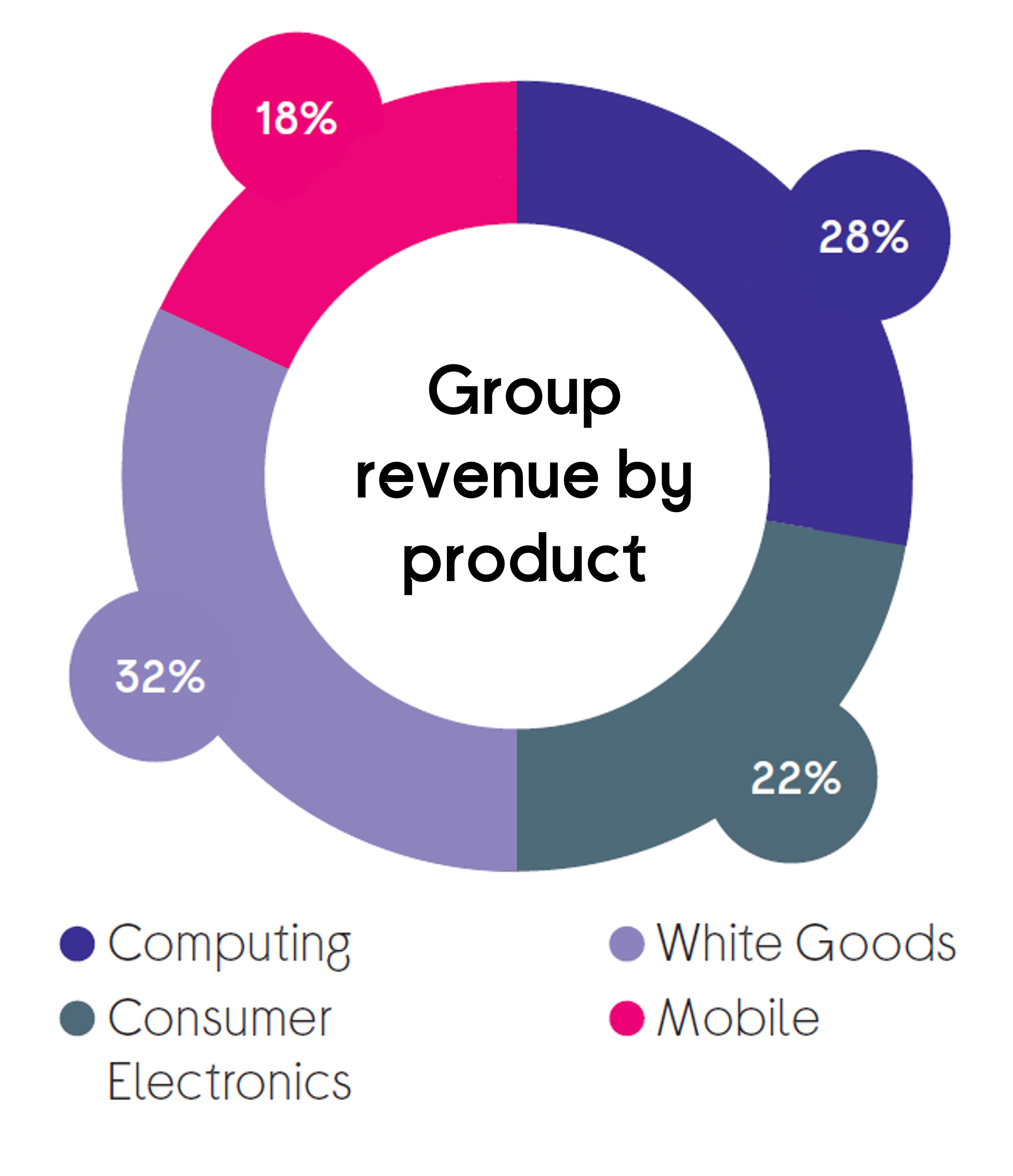

We sell a full range of products across consumer electronics, computing, domestic appliances and mobile as well as complementary services that help customers enjoy technology for life.

44%of revenues outside of UK |  |

Our extensive infrastructure is well invested and can be flexed to support sales and provide services in any channel and wherever is most convenient for customers. Our colleagues are highly engaged and help our customers enjoy technology that, while exciting, can be confusing and expensive. A better colleague experience drives a better customer experience, which in turn drives market share gains and profits.

81Group eSat score |

Customers browse and purchase tech products both in-store and online, allowing us to serve them according to their preferences and grow our market share. We are enhancing the shopping experience by integrating channels and focusing on range, price, availability, and getting it ‘Right First Time’. This ultimately helps customers choose and buy the full solutions for their needs.

38%of Group sales are online |

Our Services enable customers to enjoy technology for life. With Europe’s largest tech repair facility in Newark, and our own mobile operator, iD Mobile, we are uniquely positioned to provide these services. They deliver high margin, recurring revenue and have significant growth potential.

12mProtection plans across the Group | 1.8miD Mobile subscribers |

Our sustainability and social impact strategy has three priorities: circular business models, eradicating digital poverty, and achieving net zero emissions by 2040. Our repair facilities give us the unique ability to give tech a longer life, driving outcomes that are good for customers, the environment and our profits.

1.4mRepairs carried out in 2023/24 | 8.1me-waste products collected across the Group for reuse or recycling |

We have delivered significant cost savings over the last three years and have clear opportunities to drive more efficiencies in our business by making more of our Group’s scale and buying power, as well as harnessing the growing use cases of AI technology, which we are developing in partnership with Microsoft and Accenture.

£268mUK&I gross cost savings over the last 3 years |

We aim to improve our adjusted EBIT margins which alongside tight discipline on capital expenditure, exceptional cash and working capital, will enhance our cash flow. With a stronger balance sheet and steady growth, we aim to return increasing amount to our shareholders.

£96m2023/24 net cash |